Global payroll outsourcing: How to choose a provider and manage implementation

Ultimately, moving to the right global payroll provider creates efficiencies and lowers risks. But organisations considering the move must understand the challenges involved—from knowing what questions to ask when vetting providers to drafting an implementation plan to fulfilling payroll-related compliance obligations in all jurisdictions. These considerations are often ignored or glossed over during contract negotiations, which can leave an organisation ill-prepared to effectively implement the new payroll.

In this webinar, Vistra experts will address the most important considerations multinationals need to know before—and after—signing a contract with a global payroll provider so they can set realistic budgets, timelines, and internal expectations. Here are some areas they’ll discuss:

- Common scenarios involving global payroll outsourcing, including pain points and blind spots

- Questions to ask when vetting payroll providers

- Common ongoing payroll contract obligations

- How to draft a sound implementation plan

- The major steps of global payroll implementation, including KYC, data mapping and internal communications

- Developing policies and procedures to ensure ongoing payroll compliance across jurisdictions

- How to work effectively with your new payroll partner in the short- and long-term

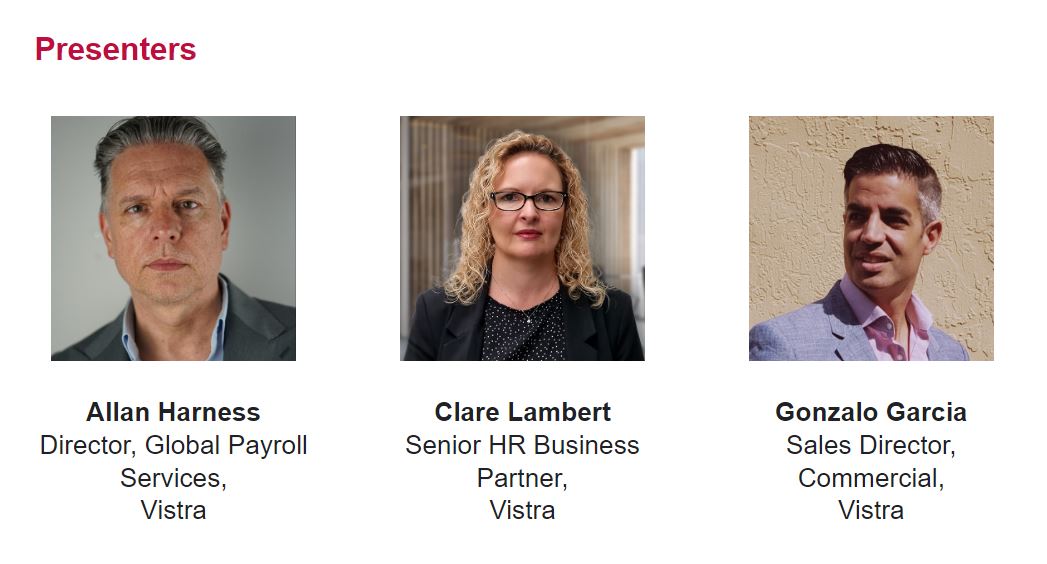

Presenters

The contents of this article are intended for informational purposes only. The article should not be relied on as legal or other professional advice. Neither Vistra Group Holding S.A. nor any of its group companies, subsidiaries or affiliates accept responsibility for any loss occasioned by actions taken or refrained from as a result of reading or otherwise consuming this article. For details, read our Legal and Regulatory notice at: https://www.vistra.com/notices . Copyright © 2024 by Vistra Group Holdings SA. All Rights Reserved.

0964.jpg)